How to use the Taxes section

Taxes

In the Taxes section, you’ll create the various tax rates that apply to the goods and services you buy for your business. You’ll designate a tax type, such as federal or state tax, provide a tax description, and the percentage rate. You can also choose whether or not to mark it as the default tax and provide a label for it.

You’ll also be able to search through tax rates and create reports based on those searches using a variety of parameters.

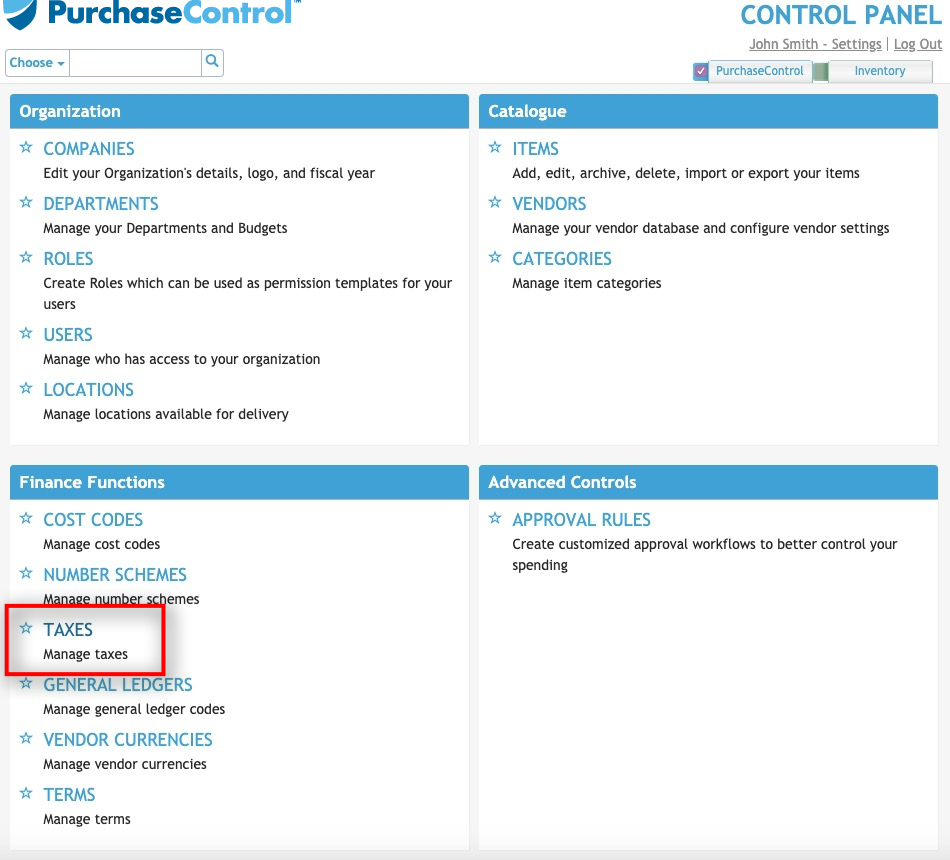

Press the Taxes button.

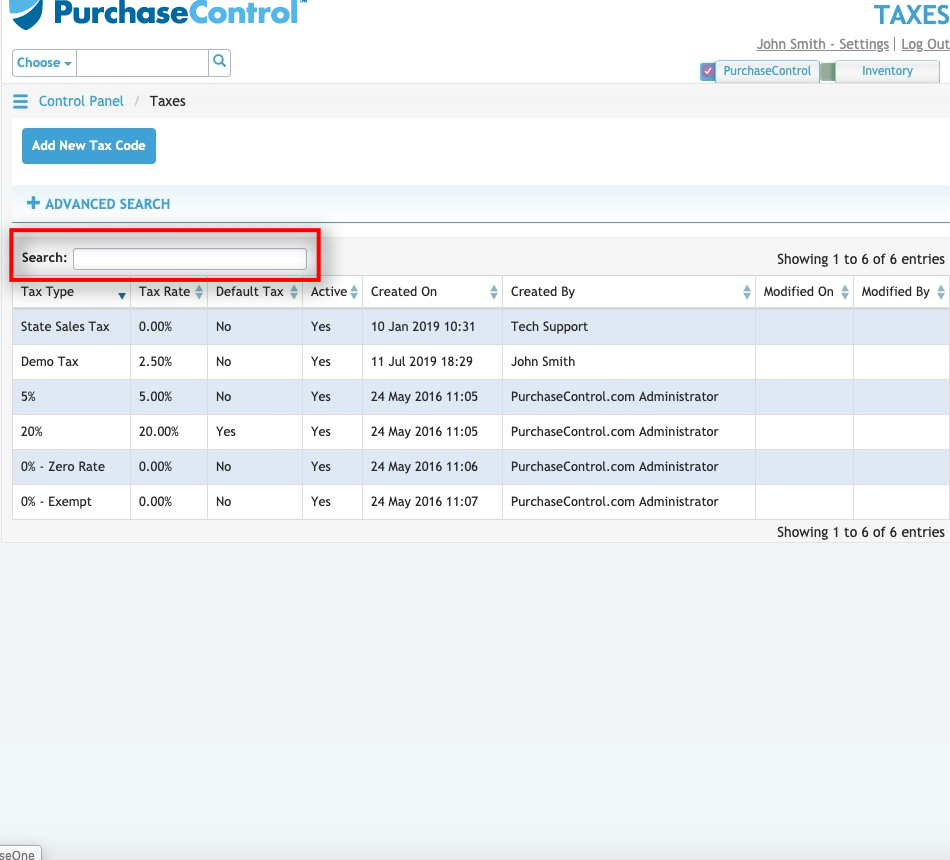

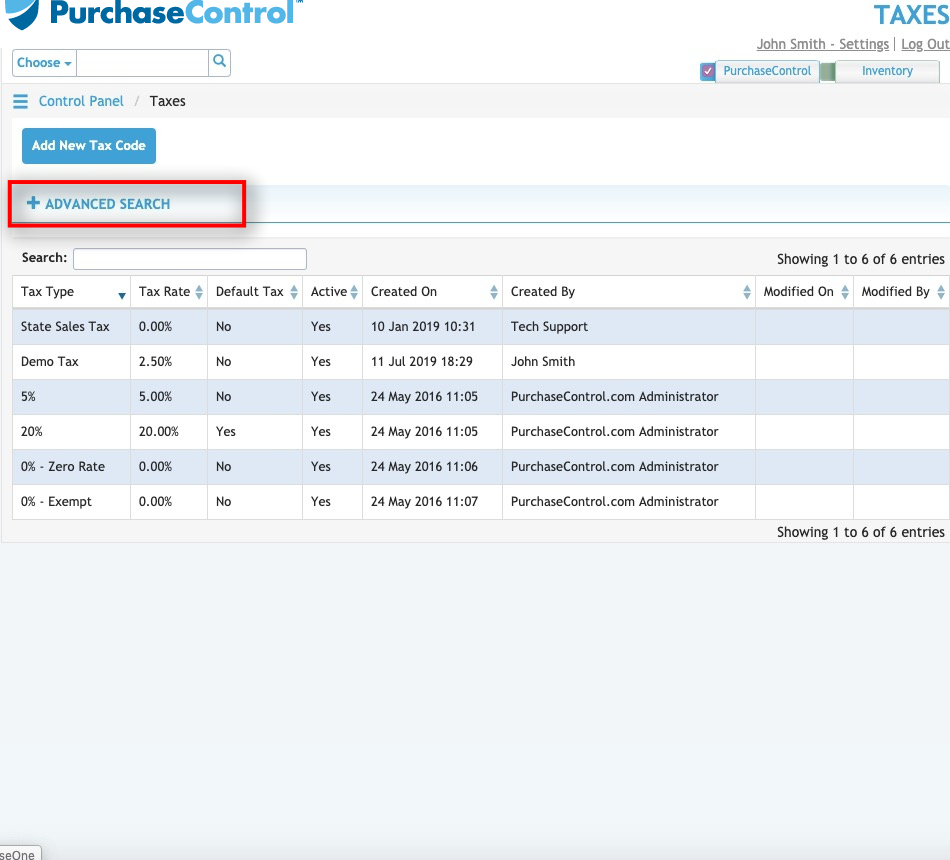

Use the Quick Search box to quickly locate a tax rate.

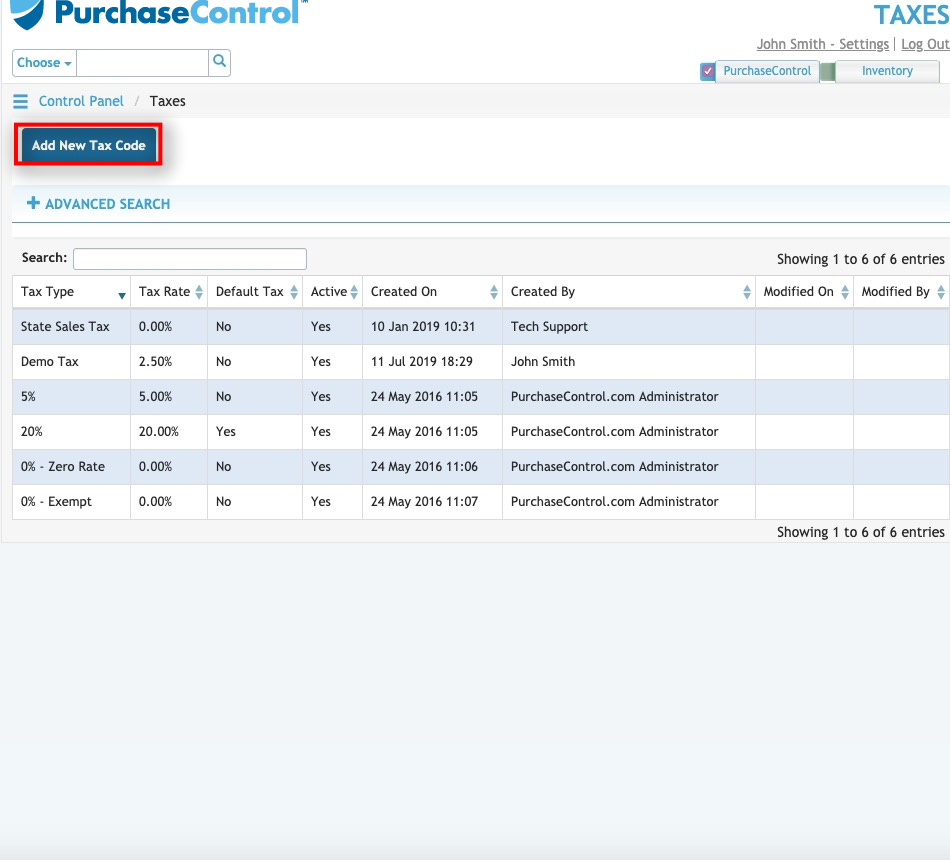

Press the Add New Tax Code button to add a new tax rate option to the system.

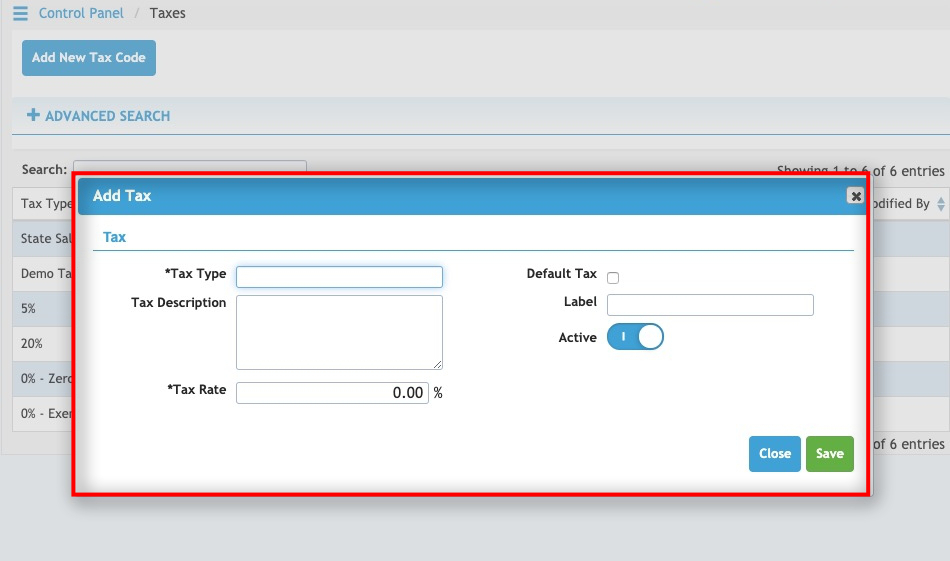

A pop-up window will appear. Enter a name for the tax type, a description, a label, and the tax rate.

Press the Default Tax checkbox to mark the current tax rate as the default one that applies to all purchase orders. At least one Default Tax is required.

The default tax applies to all line items on an invoice. The tax rate can be changed on a line by line basis, as needed depending on the rate for each item.

Press the Active switch to toggle active status on and off. It must be active to be used in the system.

When finished, press the green Save button to add the new tax rate to the system.

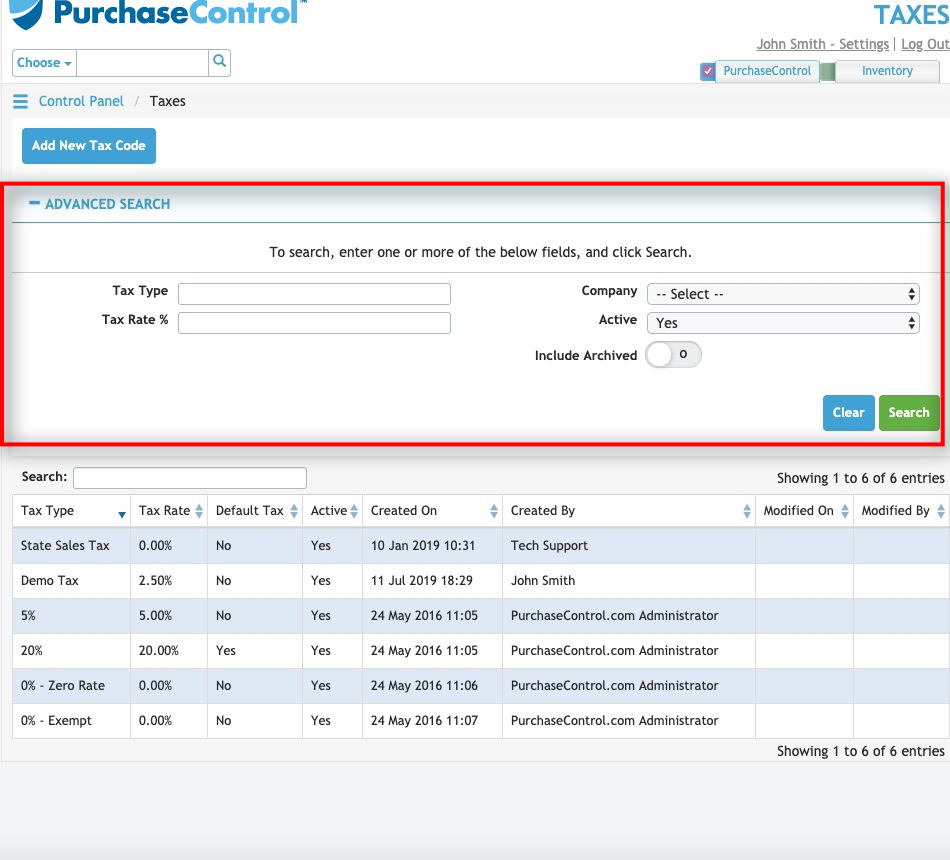

Press the Advanced Search button to open the search parameters to help you narrow down your tax rate options.

Search by tax type, the company the tax is attached to (for multiple company set ups), tax rate, and active status. Choose whether or not to include archived tax rates.

Press the green Search button to execute the search.