Taxes – 02 – Adding a New Tax

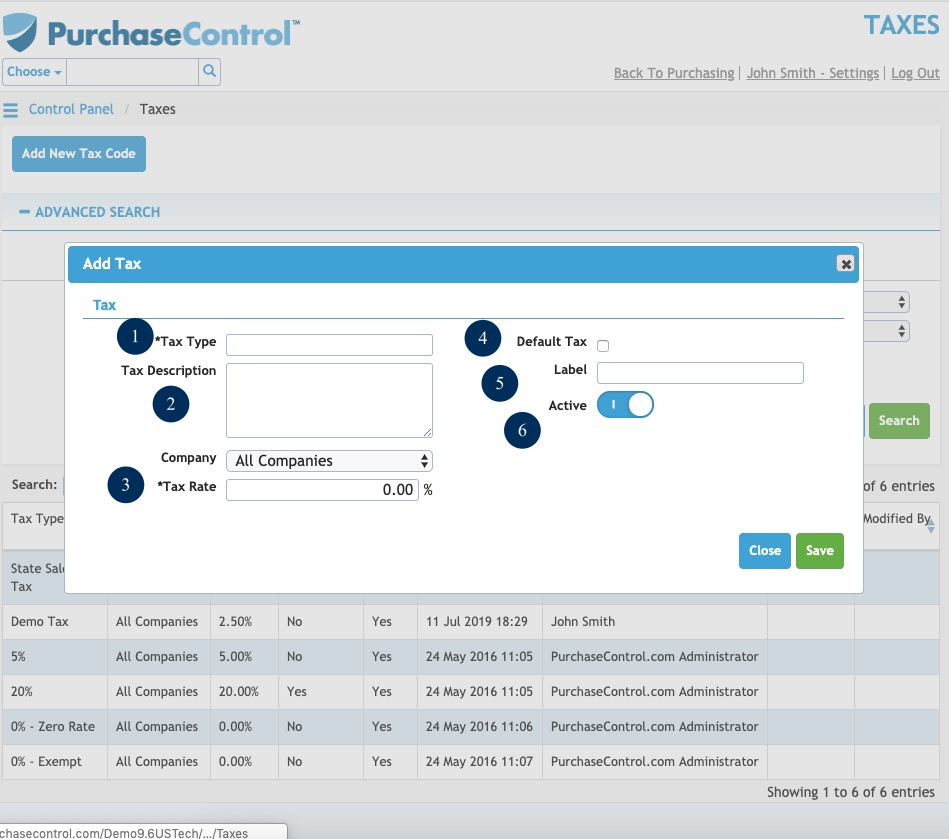

To create a new tax code you can click the Add New Tax Code button on the Tax Codes sub-section of the Finance Functions page. This will bring you to the Add Tax Code popup window. Here you can add all the details for the tax code.

Figure 5: Financial Functions Page – Add Tax Code

- Tax Name

The name of the tax code. This is what will appear on invoice. - Description

Description of the tax code. This is only visible in the Control Panel and will not appear on the invoice. - Tax Rate

The rate of the tax code. This is the percentage the tax will be calculated at. - Default Tax

Checkbox to select the default tax code as default. Only one tax code can be assigned as the default and it will automatically be assigned to each line item on an invoice. - Label

The label of the tax code. - Active

Switch to select if the tax code is active or inactive. An inactive tax code cannot be selected when creating an invoice.

Depending on the finance package you are integrating with there may be an additional field specific to that integration that needs to be set for the tax code. Code For Twinfield, Code For Sage or Xero Tax Code would need to be set to match the code used in the financial package. If you need to enable this integration contact the support team at [email protected] or use the support button in the application.